Panama Expat Life: The Value of a Dollar

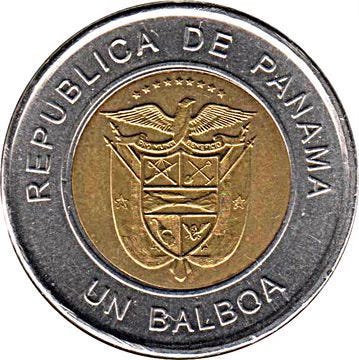

It is easy to underestimate the value of living in a country where the economy is anchored by the US Dollar. In Panama's case, the official currency is indeed the Balboa (PAB), which is pegged at a 1:1 ratio with the US Dollar. Balboas are physically represented only in coins, with denominations of 1, 5, 10, 25, and 50 centésimos, as well as a 1 Balboa coin. The 1 Balboa coins are often thick silver-colored coins with golden insets, making them distinctive but heavy AF in your pocket!

If you're US-based, you likely take for granted the assumption and privilege that your banking transactions will be settled in US dollars. However, Panama is unique in Central America as it's the only country officially accepting US dollars as legal tender alongside its national currency. This is correct - while other countries in the region may informally accept US dollars in tourist areas, Panama has fully embraced the US dollar for all transactions since its independence in 1903. This is major for expats!

You don't realize how fundamentally essential this dollar stability is until you look at currency fluctuations in neighboring countries, which can significantly devalue your purchasing power overnight. In countries like Costa Rica, Nicaragua, or Guatemala, expats constantly monitor exchange rates, timing their transfers to maximize value, and sometimes losing substantial amounts during periods of local currency volatility. When it happens, it hurts, trust me.

This monetary stability provides Panama expats with several advantages:

No exchange fees or currency conversion headaches (now you will have fees when transferring money to your local bank)

Protection against local inflation and currency devaluation

Simplicity in managing finances between Panama and the US (nothing like knowing your total net worth at any given time without conversions)

For retirees and digital nomads especially, this financial predictability removes one of the most significant stressors of expatriate life. Your retirement income or remote salary maintains consistent purchasing power, allowing you to budget with confidence and stability that's rare in most expat destinations (try this in Mexico, good luck!)

Daily Currency Quirks

If you hand over a $10 bill for a purchase in Panama, there's a high chance you'll receive back a handful of Balboa coins. I recall paying the barber, handing over a bill, and as I received several coins in change, the owner said, "Hey, did you want bills?" The look on my face was obviously anxious about walking back to my car jingling with Balboa coins, and he followed up with, "Many of our clients want coins to pay parking meters"

I advised that either was fine to be respectful, and as I used the coins to pay the parking meter later, I noted it did not take credit cards, so the coins came in handy! This small interaction highlights another practical aspect of Panama's dual-currency system – while paper bills are all US dollars, the coins you receive are often Balboas, and locals have adapted to the practical uses of each. I also figured that many local retailers don’t want to pay credit card fees. Hence, they force you to use Balboas (sometimes they don’t even accept US bills). You find that out the hard way when you are trying to exit a parking garage and there is no credit card slot. ARRRGGGHH!

This everyday reality of Panama's monetary system represents the seamless integration of US currency into daily Panamanian life. What might seem unusual to newcomers quickly becomes second nature, and often, as in my case with the parking meter, is surprisingly convenient. I just keep some Balboas in the middle console of our car, issue solved.

Banking Made Simple

Another major advantage of Panama's dollar economy is the relative ease of banking for expats. I was actually able to open a bank account with Banistmo in a single afternoon. Yes, I brought my tax returns and tons of documentation with me, but I got the account opened within hours and only had to deposit $100. I walked out with a temporary debit card (I had to call back months later for the actual card after my account got hacked—that's a story for another blog post), but in short, it has been a positive experience with Banistmo.

A particularly valuable feature is that I can wire money from my US bank and generally have the funds available the same day. There are some hefty fees from Banistmo on the inbound wire transfers, but I chalk it up to the price of doing business. Compare this to other Latin American countries, where opening a bank account as a foreigner can take weeks or even months, with multiple visits and bureaucratic hurdles.

Modern Payment Solutions

Another great thing about Panama's dollar-based economy is the widespread acceptance of modern payment methods. We use Apple Tap to Pay for most services, which settles in US dollars and adds a much higher level of security versus breaking out a physical credit card. This seamless integration with US-based payment systems means that expats can continue using their preferred digital wallets and payment apps without disruption.

This combination of traditional banking accessibility and modern fintech convenience creates a financial environment that feels surprisingly familiar to Americans, eliminating one of the most common friction points in expatriate life.

So, chalk this up to one more bonus point for making Panama your future expat home!

Ven si puedes!